No CrossRef data available.

Published online by Cambridge University Press: 18 May 2017

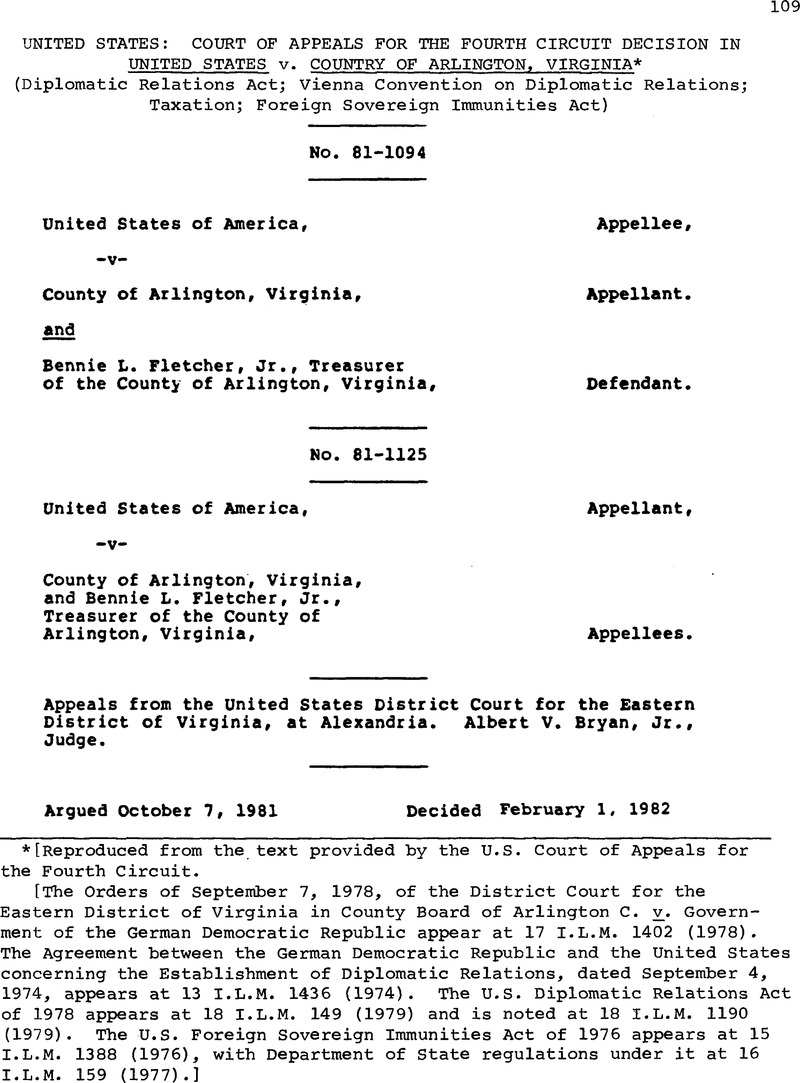

[Reproduced from the text provided by the U.S. Court of Appeals for the Fourth Circuit.

[The Orders of September 7, 1978, of the District Court for the Eastern District of Virginia in County Board of Arlington C. v. Government of the German Democratic Republic appear at 17 I.L.M. 1402 (1978). The Agreement between the German Democratic Republic and the United States concerning the Establishment of Diplomatic Relations, dated September 4, 1974, appears at 13 I.L.M. 1436 (1974). The U.S. Diplomatic Relations Act of 1978 appears at 18 I.L.M. 149 (1979) and is noted at 18 I.L.M. 1190 (1979). The U.S. Foreign Sovereign Immunities Act of 1976 appears at 15 I.L.M. 1388 (1976), with Department of State regulations under it at 16 I.L.M. 159 (1977).]

1 Agreed Minute on Negotiations Concerning the Establishment of Diplomatic Relations, 25 U.S.T. 2597, T.I.A.S. No. 7937.

2 Pub. L. No. 94-583, 90 Stat. 2891, codified as 28 U.S.C. SS 1330, 1332, 1391, 1441, 1602-11.

Section 1605(a)(2) and (4), on which the district court relied, provides in part:

(a) A foreign state shall not be immune from the jurisdiction of courts of the United States or of the States in any case––

. . . .

(2) in which the action is based upon a commercial activity carried on in the United States by the foreign state; . . .

. . . .

(4) in which rights . . . in immovable property situated in the United States are in issue . . . .

3 25 U.S.T. 2597, 2598, T.I.A.S. No. 7937. The Vienna Convention, 23 U.S.T. 3227, T.I.A.S. No. 7502, establishes rules for the conduct of diplomatic relations. Article 34 provides that a "diplomatic agent shall be exempt from all dues and taxes, personal or real, national, regional or municipal, except . . . (b) dues and taxes on private immovable property situated in the territory of the receiving State, unless he holds it on behalf of the sending State for the purposes of the mission."

4 The President delegated this power to the Secretary of State by Executive Order 12101, 43 Fed. Reg. 54,195 (1978).

5 S. Rep. No. 958, 95th Cong., 2d Sess. 5, reprinted in [1978] U.S. Code Cong. & Ad. News 1935, 1939.

6 In Nevada v. Hall the Court held that the question of Nevada's immunity from suit in California for an automobile accident caused by Nevada's agent was a matter of comity.

7 E.R. Rep. No. 1487, 94th Cong., 2d Sess. 8, reprinted in [1976] U.S. Code Cong. & Ad. News 6604, 6606-07.

8 The restrictive principle of sovereign immunity was outlined in the “Tate Letter,” 26 Department of State Bulletin 984, also reported at 6 M. Whiteman, Digest of International Law 569 (1968).

9 H.R. Rep. No. 1487, 94th Cong., 2d Sess. 7, reprinted in 11976] U.S. Code Cong. & Ad. News 6604, 6605.

10 H.R. Rep. No. 1487, 94th Cong., 2d Sess. 29 reprinted in [1976] U.S. Code Cong. & Ad. News 6604, 6628.

11 See B.R. Rep. No. 1487, 94th Cong., 2d Sess. 20, reprinted in [1976] U.S. Code Cong. & Ad. News 6604, 6619.

12 Section 1603(d) of the Act states:

A “commercial activity” means either a regular course of commercial conduct or a particular commercial transaction or act. The commercial character of an activity shall be determined by reference to the nature of the course of conduct or particular transaction or act, rather than by reference to its purpose.

13 We express no opinion about the use of the property during the period from its acquisition in 1976 to May 4, 1979. This is a fact that must be determined on remand.

14 See H.R. Rep. No. 1487, 94th Cong., 2d Sess. 20, reprinted in [1976] U.S. Code Cong. & Ad. News 6604, 6619.

15 H.R. Rep. No. 1487, 94th Cong., 2d Sess. 16, reprinted in [1976] U.S. Code Cong. & Ad. News 6604, 6615.