Article contents

General Agreement on Tariffs and Trade - Multilateral Trade Negotiations (The Uruguay Round): General Agreement on Trade in Services

Published online by Cambridge University Press: 27 February 2017

Abstract

- Type

- Treaties and Agreements

- Information

- Copyright

- Copyright © American Society of International Law 1994

References

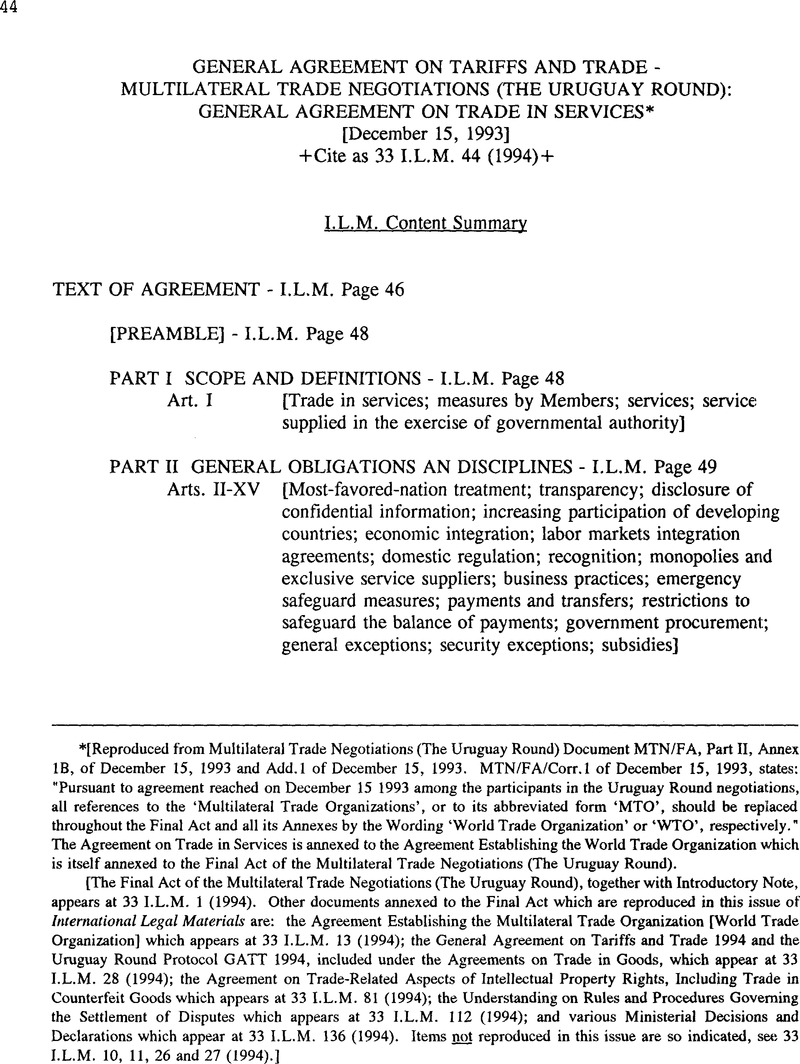

* [Reproduced from Multilateral Trade Negotiations (The Uruguay Round) Document MTN/FA, Part II, Annex IB, of December 15, 1993 and Add.l of December 15, 1993. MTN/FA/Corr. 1 of December 15, 1993, states: “Pursuant to agreement reached on December 15 1993 among the participants in the Uruguay Round negotiations, all references to the “'Multilateral Trade Organizations', or to its abbreviated form 'MTO', should be replaced throughout the Final Act and all its Annexes by the Wording 'World Trade Organization' or 'WTO', respectively.” The Agreement on Trade in Services is annexed to the Agreement Establishing the World Trade Organization which is itself annexed to the Final Act of the Multilateral Trade Negotiations (The Uruguay Round).

[The Final Act of the Multilateral Trade Negotiations (The Uruguay Round), together with Introductory Note, appears at 33 I.L.M. 1 (1994). Other documents annexed to the Final Act which are reproduced in this issue of International Legal Materials are: the Agreement Establishing the Multilateral Trade Organization [World Trade Organization] which appears at 33 I.L.M. 13 (1994); the General Agreement on Tariffs and Trade 1994 and the Uruguay Round Protocol GATT 1994, included under the Agreements on Trade in Goods, which appear at 33 I.L.M. 28 (1994); the Agreement on Trade-Related Aspects of Intellectual Property Rights, Including Trade in Counterfeit Goods which appears at 33 I.L.M. 81 (1994); the Understanding on Rules and Procedures Governing the Settlement of Disputes which appears at 33 I.L.M. 112 (1994); and various Ministerial Decisions and Declarations which appear at 33 I.L.M. 136 (1994). Items not reproduced in this issue are so indicated, see 33 I.L.M. 10, 11, 26 and 27 (1994).]

1 This condition is understood in terms of number of sectors, volume of trade affected and modes of supply. In order to meet this condition, agreements should not provide for the a priori exclusion of any mode of supply.

2 TypicaIly, such integration provides citizens of the parties concerned with a right of free entry to the employment markets of the parties and includes measures concerning conditions of pay, other conditions of employment and social benefits.

3 The term “relevant international organizations” refers to international bodies whose membership is open to the relevant bodies of at least all Members of the MTO.

4 It is understood (hat the procedures under paragraph 5 shall be the same as the GATT 1994 procedures.

5 The public order exception may be invoiced only where a genuine and sufficiently serious threat is posed to one of the fundamental interests of society.

6 Measures that are aimed at ensuring the equitable or effective imposition or collection of direct taxes include measures taken by a Member under its taxation system which: apply to non-resident service suppliers in recognition of the fact that the tax obligation of non-residents is determined with respect to taxable items sourced or located in the Member's territory;or apply to non-residents in order to ensure the imposition or collection of taxes in the Member's territory; or apply to non-residents or residents in order to prevent the avoidance or evasion of taxes, including compliance measures;or apply to consumers of services supplied in or from the territory of another Member in order to ensure the imposition or collection of taxes on such consumers derived from sources in the Member's territory; or distinguish service suppliers subject to tax on worldwide taxable items from other service suppliers, in recognition of the difference in the nature of the tax base between them;or determine, allocate or apportion income, profit, gain, loss, deduction or credit of resident persons or branches, or between related persons or branches of the same person, in order to safeguard the Member s tax base. Tax terms or concepts in Article XFV(d) and in this footnote are determined according to tax definitions and concept;, or equivalent or similar definitions and concepts, under the domestic law of the Member taking the measure.

7 For the purpose of this Agreement “direct taxes” comprise all taxes on total income, on total capital or on elements of income or of capital, including taxes on gains from the alienation of property, taxes on estates, inheritances and gifts, and taxes on the total amounts of wages or salaries paid by enterprises, as well as taxes on capital appreciation.

8 A future work programme shall determine how and in what time-frame negotiations on the multilateral disciplines will be conducted.

9 If a Member undertakes a market access commitment in relation to the supply of a service through the mode of supply referred to in paragraph 2(a) of Article I and if the cross-border movement of capital is an essential part of the service itself, that Member is thereby committed to allow such movement of capital. If a Member undertakes a market access commitment in relation to the supply of a service through the mode of supply referred to in paragraph 2(c) of Article I, it is thereby committed to allow related transfers of capital into its territory.

10 Sub-paragraph 2(c) does not cover measures of a Member which limit inputs for the supply of services.

11 Specific commitments assumed under this Article shall not be construed to require any Member to compensate for any inherent competitive disadvantages which result from the foreign character of the relevant services or service suppliers.

13 Where the service is not supplied directly by a juridical person but through other forms of commercial presence such as a branch or a representative office, the service supplier (i.e. the juridical person) shall, nonetheless, through such presence be accorded the treatment provided for service suppliers under the Agreement. Such treatment shall be extended to the presence through which the service is supplied and need not be extended to any other parts of the supplier located outside the territory where the service is supplied.

14 Interpretative Note: The sole fact of requiring a visa for natural persons of certain Members and not for those of others shall not be regarded as nullifying or impairing benefits under a specific commitment.

15 This paragraph is understood to mean that each Member shall ensure that the obligations of this Annex are applied with respect to suppliers of public telecommunications transport networks and services by whatever measures are necessary.

16 The term “non-discriminatory” is understood to refer to most-favoured-nation and national treatment as defined in the Agreement, as well as to reflect sector-specific usage of the term to mean “terms and conditions no less favourable than those accorded to any other user of like public telecommunications transport networks or services under like circumstances”.

- 1

- Cited by