No CrossRef data available.

Published online by Cambridge University Press: 04 May 2017

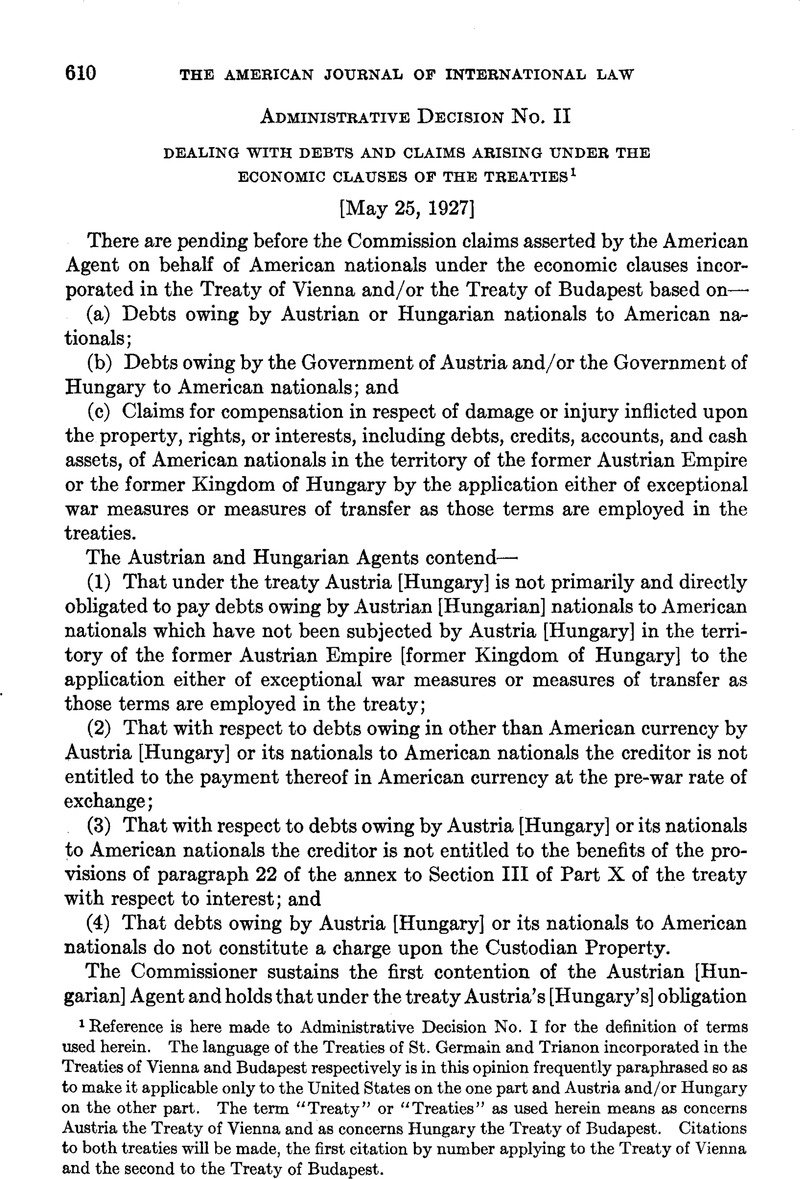

Reference is here made to Administrative Decision No. I for the definition of terms used herein. The language of the Treaties of St. Germain and Trianon incorporated in the Treaties of Vienna and Budapest respectively is in this opinion frequently paraphrased so as to make it applicable onlyto the United States on the one part and Austria and/or Hungary on the other part. The term “ Treaty” or “ Treaties” as used herein means as concerns Austria the Treaty of Vienna and as concerns Hungary the Treaty of Budapest. Citations to both treaties will be made, the first citation by number applying tothe Treaty of Vienna and the second to the Treaty of Budapest

2 The precedents of the Mixed Claims Commission, United States and Germany, in dealing with debts, credits, and accounts, including cash assets, owing by Germany or its nationals to American nationals are of comparatively little value in solving the problems here presented because of the difference in practice between Germany on the one part and Austria and/or Hungary on the other part in the application of exceptional war measures to American property; and also because by agreement between the Government of Germany and the Government of the United States, Germany assumed primary liability with respect to all such claims and debts falling within the jurisdiction of that Commission, and by another agreement they fixed the basis for the valorization of all such claims and debts. No such agreements have been entered into between the Government of the United States on the one part and the Governments of Austria and/or Hungary on the other part

3 The American delegates insisted that the adoption of the Clearing Office plan should be made optional with each of the Allied and Associated Powers, because of the difference in the economic conditions with which each and its nationals had to deal in relation to the opposing Powers and their nationals. Most of the principal Allied Powers were plunged into war with practically no warning. Their nationals had little opportunity to withdraw funds from enemy territory or liquidate or adjust existing contracts with enemy nationals. Consequently some of them—notably Great Britainin order to avoid general financial disaster to their nationals and through them to the nation, and to prevent as far as possible economic dislocation, guaranteed pre-war acceptances or carried bills of exchange and similar negotiable paper falling due after the declaration of war drawn on enemy nationals in the territory of the Central Powers. But the situation was quite different with respect to the United States and its nationals. The war between the principal Allied Powers and Austro-Hungary had been in progress for more than three years prior to the declaration of the existence of a state of war between the United States and Austro-Hungary, during which period American nationals had had ample opportunity in their discretion to withdraw their funds from Austrian and Hungarian territory and liquidate and adjusttheir contracts with Austrian and Hungarian nationals.

Had the United States adopted the Clearing Office plan it would have been required to complete the liquidation of all Custodian Property held by it and to account for the proceeds thereof through the Clearing Offices. These requirements ran counter to the express provisions of Section 12 of the American Trading with the Enemy Act which expressly reserved to Congress after the end of the war the right to determine the disposition to be made of seized enemy property. The Clearing Office plan contemplated the guaranty by both the United States and Austria [Hungary] of the payment of the private debts of their respective nationals and prohibited the voluntary settlement of debts between such nationals. It was believed that such a guaranty would have been repugnant to American conceptions of the functions of government and such interference with private contract rights in time of peace would have been repugnant to the spirit of American institutions.

4 These provisions for the application by the United States of Austrian and/or Hungarian property and the proceeds of the liquidation thereof as an alternate method of payment are inharmony with the American Trading with the Enemy Act, leaving to the Congress the untrammeled right to dispose of such property and the proceeds thereof in its discretion

5 Article 248 [231] (d) reads as follows:

“ Debts shall be paid or credited in the currency of such one of the Allied and Associated Powers, their colonies or protectorates, or the British Dominions or India, as may be concerned. If the debts are payable in some other currency they shall be paid or credited in the currency ofthe country concerned, whether an Allied or Associated Power, Colony, Protectorate, British Dominion or India, at the pre-war rate of exchange.

“ For the purpose of this provision the pre-war rate of exchange shall be defined as the average cable transfer rate prevailing in the Allied or Associated country concerned during the month immediately preceding the outbreak of war between the said country concerned and Austria-Hungary

“ If a contract provides for a fixed rate of exchange governing the conversion of the currency in which the debt is stated into the currency of the Allied or Associated country concerned, then the above provisions concerning the rate of exchange shall not apply.

“ In the case of the new states of Poland and the Czecho-Slovak State the currency in which and the rate of exchange at which debts shall be paid or credited shall be determined by the Reparation Commission provided for in Part VIII, unless they shall have been previously settled by agreement between the states interested.”

“ Subject to any special agreement to the contrary between the governments concerned debts shall carry interest in accordance with the following provisions

“ Interest shall not be payable on sums of money due by way of dividend, interest or other periodical payments which themselves represent interest on capital

“ The rate of interest shall be 5 per cent, per annum, except in cases where, by contract, law or custom, the creditor is entitled to payment of interest at a different rate. In such cases the rate to which he is entitled shall prevail

“ Interest shall run from the date of commencement of hostilities (or, if the sum of money to be recovered fell due during the war, from the date at which it fell due) until the sum is credited to the Clearing Office of the creditor

“ Sums due by way of interest shall be treated as debts admitted by the Clearing Offices and shall be credited to the creditor Clearing Office in the same way as such debts.”

6 “ In the settlement of matters provided for in Article 249 [232] between Austria [Hungary] and the Allied or Associated Powers, their colonies or protectorates, or any one of the British Dominions or India, in respect of any of which a declaration shall not have been made that they adopt Section III, and between their respective nationals, the provisions of Section III respecting the currency in which payment is to be made and the rate of exchange and of interest shall apply unless the Government of the Allied or Associated Power concerned shall within six months of the coming into force of the present treaty notify Austria [Hungary] that one or more of the said provisions are not to be applied.”

7 Margaret Williams v. Berlinische Lebens-Versicherungs Gesellschaft, Anglo-German Mixed Arbitral Tribunal, V Dec. M. A. T. at page 325; National Bank of Egypt v. German Government and Bank fur Handel und Industrie, ibidem, page 26

8 8Debts owing to American nationals by nationals of the former Austrian Empire [former Kingdom of Hungary] who under the treaties became nationals of other states included in the designation “ Allied and Associated Powers” are not here included. The nationals of such succession states are not enemy debtors, the American creditors are not as to them enemy creditors, and the debts owing bythem are not“enemy debts” and are not included within the term “ debts” as here used(paragraph 2 of the annex to Section III). Provision is made for the prompt return by Austria [Hungary] to the nationals of such succession states of their property, rights, and interests, including debts, credits, and accounts, situated in Austrian [Hungarian] territory (Article 266 [249]). Special provision was made for the settlement of debts between nationals of such succession states and Austrian [Hungarian] nationals (Article 271 [254] and paragraph (d) of Article 248 [231]). Provision was made by the Congress of the United States for the release and return of the property, rights, and interests, and the proceeds of the liquidation thereof, of the nationals of such succession states, which consequently are no longer charged with and cannot be applied to the payment of claims and debts of American nationals as provided in paragraph (h) (2) of Article 249 [232] (see subsection (6) of Section 9 of the Trading with the Enemy Act as amended by the Act of June 5, 1920, 41 Statutes at Large 978).

9 The term “ residing” as here used with respect to time as affecting debts means residing at any time falling within the period of American belligerency after the debt became due, provided all cash demand deposits will, for this purpose, be treated as due

10 See agreement between the British and Hungarian Governments, ratifications of which were exchanged at London on April 20, 1922, copied in full in the supplement to Volume 17 (1923) American Journal of International Law, pages 46-48. Paragraph 5 of that agreement reads as follows: “ To remove doubts the claims by British nationals with regard to their property, rights and interests with the payment of which all property, rights and interests of Hungarian nationals within British territory, and the net proceeds of the sale, liquidation or any other dealings therewith may under paragraph 4 of the annex to Section IV of Part X of the treaty be charged shall be deemed to include the classes of pecuniary obligations referred to in paragraphs (3) and (4) of Article 231 of the treaty.”

Rubens v. Austrian Government, III Dec. M. A. T. 37; The Municipal Trust Co., Ltd., v. Hungarian Government, ibidem, 248. While these cases were appeals from Clearing Office decisions, nevertheless they throw some light on the question here considered

11 “ In Article 249 [232] and this annex the expression exceptional war measures includes measures of all kinds, legislative, administrative, judicial or others, that have been taken or will be taken hereafter with regard to enemy property, and which have had or will have the effect of removing from the proprietors the power of disposition over their property, though without affecting the ownership, such as measures of supervision, of compulsory administration, and of sequestration; or measures which have had or will have as an object the seizure of, the use of, or the interference with enemy assets, for whatsoever motive, under whatsoeverorm or in whatsoever place.Acts in the execution of these measures include all detentions, instructions, orders or decrees of Government departments or courts applying these measures to enemy property, as well as acts performed by any person connected with the administration or the supervision of enemy property, such as the payment of debts, the collecting of credits, the payment of any costs, charges or expenses, or the collecting of fees

“ Measures of transfer are those which have affected or will affect the ownership of enemy property by transferring it in whole or in part to a person other than the enemy owner, and without his consent, such as measures directing the sale, liquidation or devolution of ownership in enemy property, or the cancelling of titles or securities.”

12 The term “ pre-war” applicable to the United States and its nationals as used in paragraph (d) of Article 248 [231] fixing the rate of exchange refers to a time prior to December 7, 1917, while the same term as applied to Great Britain, France, and other Allied Powers refers to a time prior to the entry (on July 28, 1914, or later) of each into war with the Central Power concerned in the particular treaty. During this period of American neutrality many of the debts which form the basis of claims before this Commission were incurred. Likewise during this period of more than three years the Austro-Hungarian krone as measured by the American exchange value depreciated to less than one-half of its par value. Consequently the treaty pre-war rate of exchange applicable to Great Britain, France, and some of the other Allied Powers and their respective nationals is more than double the treaty rate applicable to the United States and its nationals

13 In carrying these provisions into effect the provisions of Section III respecting currency and rates of exchange and interest must be taken into account in measuring the extent of the damage inflicted by Austria act or the amount which Austria [Hungary] is required to pay from the proceeds of liquidation of American property

14 This is the effect of the decision rendered by the Supreme Court of the United States on November 23, 1926, in the case of Die Deutsche Bank Filiale Nurnberg v. Charles Franklin Humphrey. Mr. Justice Holmes in delivering the opinion of the court said:

“ An obligation in terms of the currency of a country takes the risk of currency fluctuations and whether creditor or debtor profits by the change the law takes no account of it. Legal Tender Cases, 12 Wall. 457, 548, 549. Obviously in fact a dollar or a mark may have different values at different times but to the law that establishes it it is always the same. If the debt had been due here and the value of dollars had dropped before suit was brought the plaintiff could recover no more dollars on that account. A foreign debtor should be no worse off.”

15 The reasoned opinions of the Mixed Arbitral Tribunals constituted under the Treaty of Versailles and similar treaties involving private debts between nationals of non-clearing states sustain the view here expressed. National Bank of Egypt v. German Government and Bank fur Handel und Industrie, V Dec. M. A. T. 26; Margaret Williams v. Berlinische Lebens-Versicherungs Gesellschaft, ibidem 322

16 Paragraph (h) (.2) of Article 249 [232] provides that the Custodian Property “ shall be subject to disposal by such Power [United States] in accordance with its laws and regulations.” Section 5 of the [Knox-Porter] peace resolution adopted by the Congress of the United States and incorporated in the Treaty of Vienna [Budapest] provides that the Custodian Property “ shall be retained by the United States of America and no disposition thereof made except as shall have been heretofore or specifically hereafter shall be provided by law,” etc.

17 Paragraph (h) (2) of Article 249 [232] and paragraph 4 of the annex to Section IV. It will be noted that these clauses of the treaties providing for this alternate method of payment are so drawn as to harmonize with the provisions of the American “ Trading with the Enemy Act” which reserved to the Congress of the United States the right to dispose of the Custodian Property and also with Section 4 of the peace resolution incorporated in the treaties which reserved to the United States all rights “ to which it is entitled by virtue of any Act or Acts of Congress,” including the Trading with the Enemy Act, and also with Section 5 of the peace resolution incorporated in the treaties which provides that the Custodian Property “ shall be retained by the United States of America and no disposition thereof made except as shall have been heretofore or specifically hereafter shall be provided by law until such time ”

18 Should the United States elect to apply the Custodian Property to the payment of the claims and debts of American nationals it must to the extent of the amounts so applied credit Austria [Hungary] and the latter in turn is obligated to compensate its nationals in respect of the proceeds of the liquidation of their property so applied. Moreover, the United States to the extent it shall exercise the right reserved to it under paragraph (b) of Article 249 [232] to retain and liquidate Custodian Property one of the matters provided for in Article 249 [232] must, in the settlement of such liquidation, apply the provisions of Section III respecting currency and rates of exchange and interest. National Bank of Egypt v. German Government and Bank fur Handel und Industrie, Anglo-German Mixed Arbitral Tribunal, Y Dec. M. A. T. 26.

19 See Administrative Decision No. I dealing with the functions and jurisdiction of the Commission. There is thus combined in one tribunal functions which under the Treaty of St. Germain [Trianon] and similar treaties between the Allied Powers and the Central Powers were allocated to the Reparation Commission, the Mixed Arbitral Tribunals, and an Arbitrator appointed in pursuance of paragraph 4 of the annex to Section IV of Part X.